|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Home Refinance with Cash Out: A Comprehensive GuideUnderstanding Cash-Out RefinancingCash-out refinancing is a popular option for homeowners looking to tap into their home's equity. It allows you to refinance your mortgage for more than you currently owe and take the difference in cash. Benefits of Cash-Out Refinancing

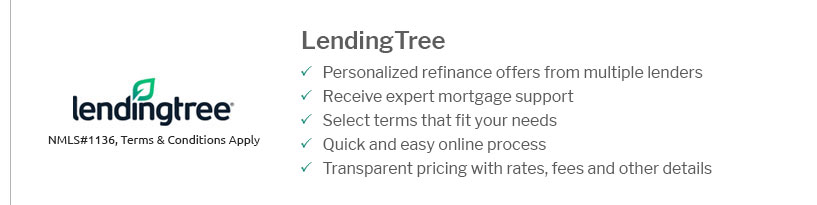

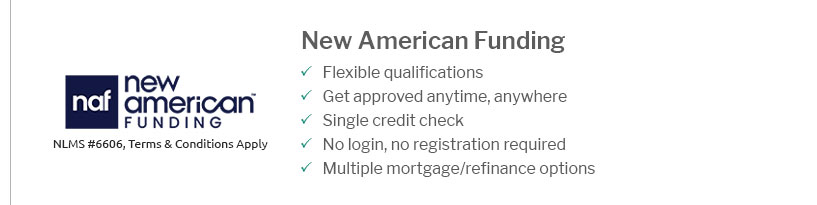

Considerations Before ProceedingBefore opting for a cash-out refinance, evaluate your financial situation. Consider your credit score, home value, and long-term financial goals. For more information, visit fha refinance after chapter 13. How to Choose the Best Cash-Out Refinance LenderResearch and Compare LendersIt's crucial to shop around and compare offers from different lenders. Look for competitive interest rates and favorable terms. Evaluate Fees and Closing CostsBe mindful of any fees or closing costs associated with refinancing. These can impact the overall benefit of the cash-out option.

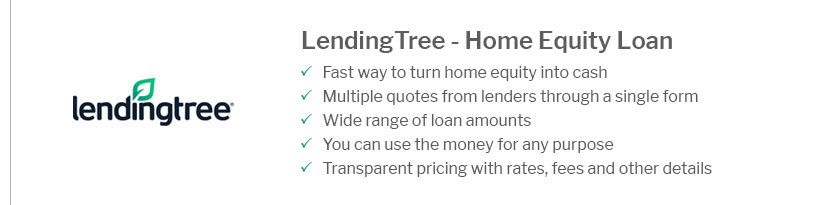

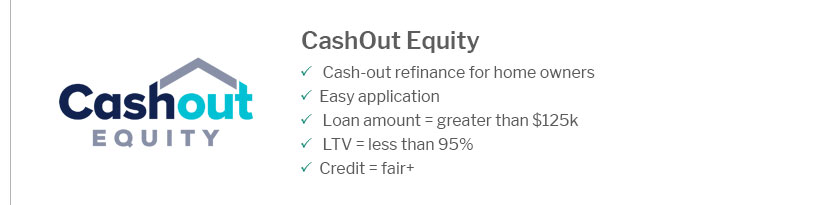

Check Eligibility RequirementsLenders may have specific eligibility criteria, such as a minimum credit score or loan-to-value ratio. Ensure you meet these requirements to qualify for the best rates. When to Consider a Cash-Out RefinanceTiming is crucial when considering a cash-out refinance. Market conditions, such as low-interest rates, can make this option more attractive. For further understanding of refinancing, explore fha streamline refinance meaning. Frequently Asked QuestionsWhat is the difference between cash-out refinancing and a home equity loan?Cash-out refinancing replaces your existing mortgage with a new one, while a home equity loan is a second loan on top of your existing mortgage. Cash-out refinancing typically offers lower interest rates compared to home equity loans. How does cash-out refinancing affect my taxes?Interest on the new mortgage may be tax-deductible if the loan is used to buy, build, or substantially improve your home. Consult with a tax advisor for personalized advice. Can I refinance with cash out if I have bad credit?It may be challenging to qualify for a cash-out refinance with bad credit, but it's not impossible. Some lenders offer specialized programs for borrowers with lower credit scores. https://www.cnbc.com/select/best-mortgage-refinance-lenders/

Best for low rates: Better - Best for online tools: Magnolia Bank - Best for speedy closing: Rocket Mortgage - Best for availability: PNC Bank - Best credit union: ... https://www.investopedia.com/terms/c/cashout_refinance.asp

With a cash-out refinance, you take out a larger mortgage loan, use the proceeds to pay off your existing mortgage and receive the remaining funds as a lump sum ... https://www.credible.com/mortgage/best-cash-out-refinance-lenders

Rocket Mortgage: This lender is best for borrowers who would prefer to roll closing costs into their new loan. - Caliber Home Loans: - PenFed Credit Union: - SoFi: ...

|

|---|